Table Of Content

What Is a Bitcoin Wallet?

A Bitcoin wallet is a digital tool that lets you store, send, and receive Bitcoin securely. It doesn't hold physical coins—instead, it stores your private keys, which give you access to your cryptocurrency.

Software vs. Hardware: You can choose between software wallets (apps like Exodus or Trust Wallet) or hardware wallets (physical devices like Ledger or Trezor) depending on your need for accessibility or security.

Hot vs. Cold Storage: Hot wallets are connected to the internet and more convenient, but cold wallets are offline and offer better protection from hacks.

Custodial vs. Non-Custodial: Custodial wallets (like on Coinbase) are managed by a third party, while non-custodial wallets give you full control—but also full responsibility.

Platform | Supported Coins | Swap Fee | MetaMask Wallet | +16 | 0.875% |

|---|---|---|

Coinbase Wallet | +3,000 | 1% |

Trust Wallet | +5,000 | 0%

Users still need to pay blockchain network fees (gas fees) and potential liquidity provider fees when swapping assets |

Ledger Hardware Wallet | +5,000 | About 0.25%

The Swap service is facilitated by third-party providers such as Changelly and ParaSwap, each with their own fee structures. For instance, Changelly charges a transaction fee of approximately 0.25%. |

Exodus Wallet | +300 | 0%

Users still need to pay blockchain network fees (gas fees) and potential liquidity provider fees when swapping assets |

Crypto.com OnChain | +1,000 | 0.3% |

-

Software vs. Hardware Bitcoin Wallets

Bitcoin wallets come in two primary types: software wallets, which are apps or desktop programs, and hardware wallets, which are physical devices.

Software wallets are convenient for frequent use, but hardware wallets offer higher security for large holdings.

For example, someone who trades daily may prefer a mobile wallet like Trust Wallet, while a long-term investor may store assets offline with a Ledger device.

Also, software wallets are free, while hardware wallets involve an upfront cost.

Feature | Software Wallet | Hardware Wallet |

|---|---|---|

Accessibility | Easy access via phone or computer | Requires connecting physical device |

Security | Vulnerable to malware or phishing | High security; offline storage |

Cost | Usually free | $50–$200 (one-time purchase) |

Best For | Frequent traders, small balances | Long-term holders, large balances |

-

Hot vs. Cold Storage

The terms “hot storage” and “cold storage” describe whether your Bitcoin wallet is connected to the internet.

Hot wallets are ideal for active users who frequently send or receive Bitcoin. Cold wallets, on the other hand, are offline and better suited for secure long-term storage.

For instance, storing Bitcoin on a web wallet like MetaMask is fast, but a cold wallet like Trezor is safer from hacks.

Feature | Hot Wallet | Cold Wallet |

|---|---|---|

Internet Connection | Always connected | Completely offline |

Convenience | High – ideal for quick transactions | Low – manual setup needed |

Security Risk | Higher (online exposure) | Minimal (not exposed online) |

Example Use Case | Daily trading or crypto payments | Long-term crypto storage |

-

Custodial vs. Non-Custodial Wallets

With custodial wallets, a third party like an exchange (e.g., Coinbase) holds your private keys, making them easier for beginners.

But non-custodial wallets give you full control—meaning you're responsible for securing your keys. This distinction matters because if a custodial platform is hacked, your funds may be at risk.

In contrast, if you lose access to a non-custodial wallet (like MetaMask) and don't back up your recovery phrase, your Bitcoin is gone.

Feature | Custodial Wallet | Non-Custodial Wallet |

|---|---|---|

Key Ownership | Held by platform | You own and manage your keys |

Control | Limited – depends on service | Full – no third-party access |

Ease of Use | Easier for beginners | Requires more responsibility |

Recovery Options | Platform can help recover access | You must store backup phrase securely |

How Bitcoin Wallets Work: Public and Private Keys Explained

Bitcoin wallets function using two critical components: a public key and a private key. These keys form the backbone of Bitcoin transactions and ownership.

Public Key: This is your wallet’s receiving address. Anyone can send Bitcoin to this address, like sharing your email to receive messages.

Private Key: This secret code proves ownership of the funds in your wallet. Without it, you can’t move or spend your Bitcoin.

Wallets Generate Keys: When you set up a wallet, it automatically creates a matching pair of public and private keys for each address used for transactions.

Security Matters: If someone gains access to your private key, they can take your Bitcoin—therefore, storing it securely is crucial.

For example, if you send Bitcoin from your hardware wallet, it signs the transaction using your private key—without ever exposing that key to the internet.

How to Choose a Bitcoin Wallet for Your Needs?

Picking the right Bitcoin wallet depends on your experience level, how often you trade, and your security preferences.

Determine Your Usage: If you're actively buying and selling Bitcoin, a mobile or web wallet like Trust Wallet or Coinbase Wallet offers convenience.

Evaluate Security Needs: For larger holdings or long-term storage, a hardware wallet such as Ledger or Trezor is much safer because it stays offline.

Check Custody Preferences: Some prefer custodial wallets for ease of use, but others may want full control with a non-custodial wallet.

Consider Multi-Coin Support: If you plan to hold other cryptocurrencies, choose a wallet that supports multiple coins and tokens.

Think about your long-term goals—if you're investing $50 for fun, you may be fine with a hot wallet. But if you're managing thousands, prioritize cold storage.

Popular Bitcoin Wallets for Beginners

If you're new to Bitcoin, starting with a simple, well-reviewed wallet can help you avoid mistakes and protect your funds.

Wallet | Type | Key Features |

|---|---|---|

Coinbase Wallet | Software (Mobile/Web) | dApp access, easy integration with Coinbase exchange |

Trust Wallet | Software (Mobile) | Multi-asset support, staking, in-app DEX |

Exodus | Software (Desktop/Mobile) | Beautiful UI, supports many cryptos, built-in swap |

Electrum | Software (Desktop) | Lightweight, fast, customizable fees |

Ledger Nano S Plus | Hardware | Offline storage, Ledger Live app |

MetaMask | Software (Mobile/Web) | Ethereum-focused, can hold wrapped BTC |

Crypto.com DeFi Wallet | Software (Mobile) | Non-custodial, staking, dApp integration |

-

Coinbase Wallet

Coinbase Wallet is a non-custodial wallet designed for beginners using the Coinbase exchange.

It allows you to store your Bitcoin and interact with decentralized apps (dApps) without needing a centralized service.

The interface is sleek and simple, making it easy to send or receive Bitcoin even if you're new to crypto. However, you're responsible for your own keys, so backing up your recovery phrase is essential.

-

Trust Wallet

Trust Wallet is a mobile-first, multi-asset crypto wallet ideal for beginners who want to hold Bitcoin and altcoins.

It supports a wide range of blockchains and lets you stake coins, explore Web3 apps, or use decentralized exchanges—all from your phone.

Because it's non-custodial, you maintain full control of your funds. It’s a solid choice if you want something flexible, secure, and beginner-friendly on mobile.

-

Exodus

Exodus stands out for its beautifully designed interface on both desktop and mobile, making it easier for beginners to navigate crypto.

It supports over 100 cryptocurrencies, including Bitcoin, and features built-in exchange capabilities for easy asset swaps. While it's not open-source, it prioritizes user experience and integrates with Trezor hardware wallets for added security.

It's perfect if you're just starting and want something user-friendly without sacrificing functionality.

-

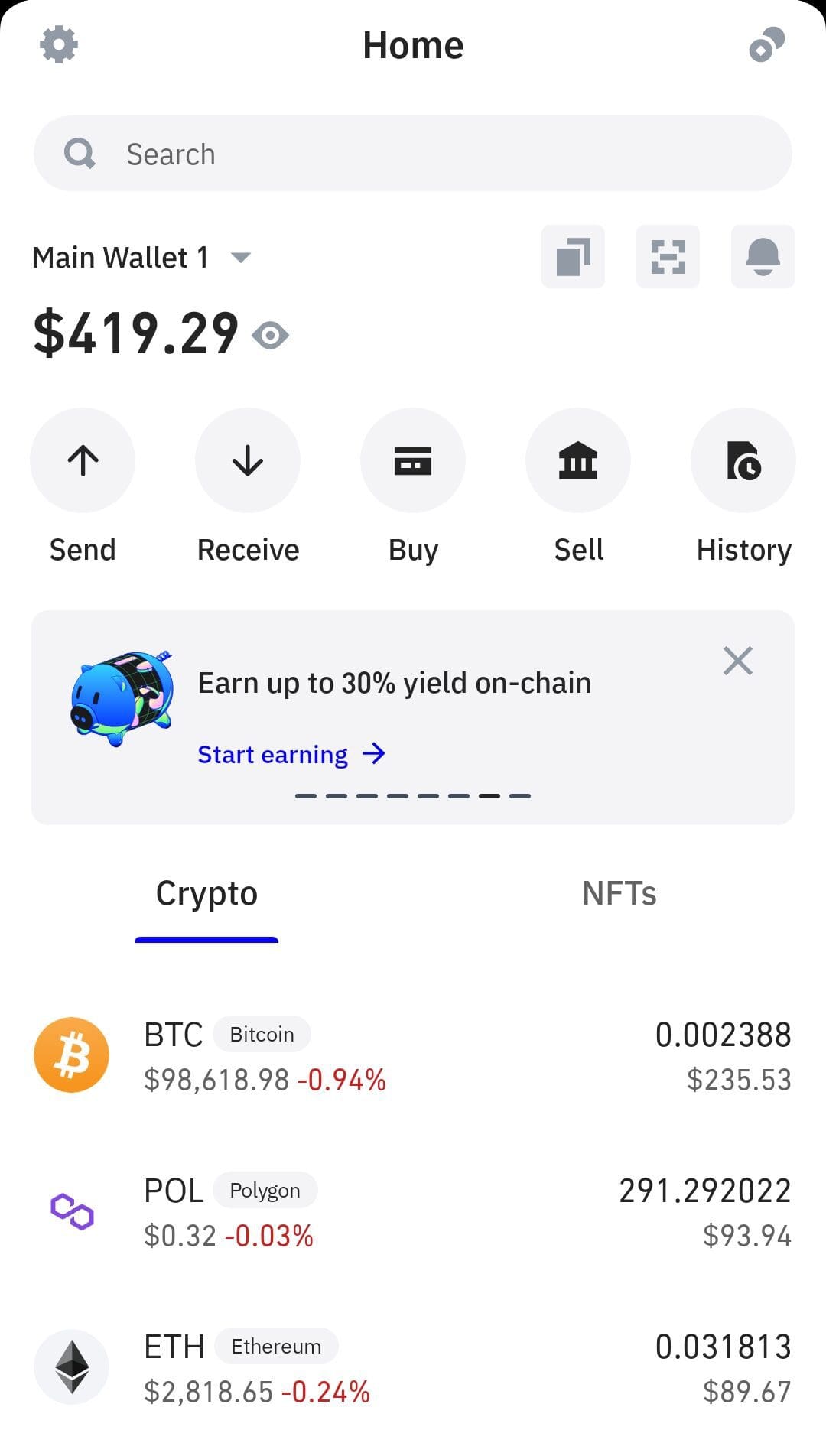

Crypto.com DeFi Wallet (On-Chain)

The Crypto.com DeFi Wallet is a non-custodial wallet designed to give beginners easy access to on-chain crypto storage and decentralized finance tools.

Unlike the main Crypto.com app, this wallet lets you control your private keys and directly interact with dApps and DeFi platforms.

It supports Bitcoin, Ethereum, and many other assets, with features like token swaps and staking built right into the app.

-

Ledger Nano S Plus

The Ledger Nano S Plus is a popular hardware wallet that offers cold storage, meaning your private keys never interact with the internet.

It’s ideal for beginners who want to store their Bitcoin long-term without exposure to hacks or malware. The wallet connects via USB and is managed through the Ledger Live app, which allows you to monitor your balance and install apps for multiple coins.

It’s secure, reliable, and worth the investment if you’re serious about protecting your crypto.

-

MetaMask (with Wrapped Bitcoin)

MetaMask is primarily for Ethereum and ERC-20 tokens, but some beginners use it to hold Bitcoin in the form of Wrapped BTC (WBTC) on Ethereum.

This method allows you to use Bitcoin in DeFi apps, but it requires bridging and trusting third-party protocols. MetaMask is beginner-friendly in design but slightly advanced in use when it comes to Bitcoin.

If you're exploring DeFi and want to experiment with Bitcoin on Ethereum, it could be worth considering—just proceed carefully.

FAQ

Many Bitcoin wallets also support other cryptos, especially multi-asset wallets like Trust Wallet or Exodus. However, some like Electrum are Bitcoin-only.

If it's a custodial wallet, the provider may help recover access. For non-custodial wallets, recovery depends on whether you backed up your seed phrase.

Most software wallets are free to download and use. However, hardware wallets require a one-time purchase, and transactions still carry blockchain fees.

Hot wallets need internet to function, but cold wallets like Ledger only connect when needed, offering more security by staying offline most of the time.

Yes, you can use multiple wallets for different purposes—one for daily transactions and another for secure long-term storage, for example.

A wallet stores your private keys and lets you control your crypto. An exchange account is usually custodial and controlled by a third party.

Mobile wallets are convenient, but they’re exposed to online risks. Using strong passwords and enabling 2FA can improve security.

Yes, non-custodial wallets don't require ID verification. Custodial wallets like Coinbase usually require KYC for compliance purposes.

A seed phrase is a series of words that backs up your wallet. If your device is lost or damaged, you can use this phrase to restore access.

No, your public address is safe to share. It's like an email address. Only your private key can authorize transactions, so keep it hidden.

Not always. You’ll need to check if the wallet supports Bitcoin Cash or other forks separately, especially for non-mainstream cryptocurrencies.