Table Of Content

While holding quality stocks for the long term can build wealth, there are times when selling is the smarter move.

Whether it's a shift in your personal goals, company fundamentals, or broader market conditions, knowing when to exit a stock can help protect your gains—and your portfolio.

1. Your Life Goals or Risk Tolerance Have Changed

As your financial situation evolves—whether you're nearing retirement, saving for a house, or dealing with unexpected costs—your portfolio should reflect those changes. A stock that once made sense might no longer align with your timeline or risk profile.

Ask yourself:

Has your risk tolerance shifted with age or life events?

Do you now need more income or capital preservation?

Does the stock still fit your financial goals?

Life Stage | Common Reason to Sell | Investment Adjustment |

|---|---|---|

Early Career | High risk tolerance, switching strategies | Sell underperformers to pursue growth opportunities |

Mid-Career | Saving for home or family expenses | Sell volatile stocks, shift toward more balanced exposure |

Pre-Retirement | Focus on capital preservation | Reduce high-risk holdings, add dividend or bond exposure |

Retirement | Need for income and low volatility | Sell growth stocks, shift into income-producing investments |

-

Selling a Stock as Your Goals Evolve: Example

Say you’ve been holding a high-growth, high-volatility stock like Tesla (TSLA) for several years.

Now, with retirement around the corner, you’re more focused on stability and income.

Selling some or all of your position and reallocating into a dividend-paying stock like Johnson & Johnson (JNJ) could help reduce volatility and support income needs.

2. The Stock No Longer Fits Your Portfolio Strategy

Sometimes a stock that once made sense becomes redundant or too risky within your broader portfolio. This can happen when you buy new investments that overlap sectors or add unintended concentration.

Situations to watch for:

Holding multiple stocks in the same industry or theme

Portfolio drift due to market gains

Need to diversify into other sectors or asset types

-

Trimming or Selling Overlapping Stocks: Example

Suppose you hold both Apple (AAPL) and Microsoft (MSFT) for tech exposure. Then you add an S&P 500 index fund that also heavily features these names.

You may be doubling down without realizing it. Selling one of the stocks can help rebalance and avoid overexposure.

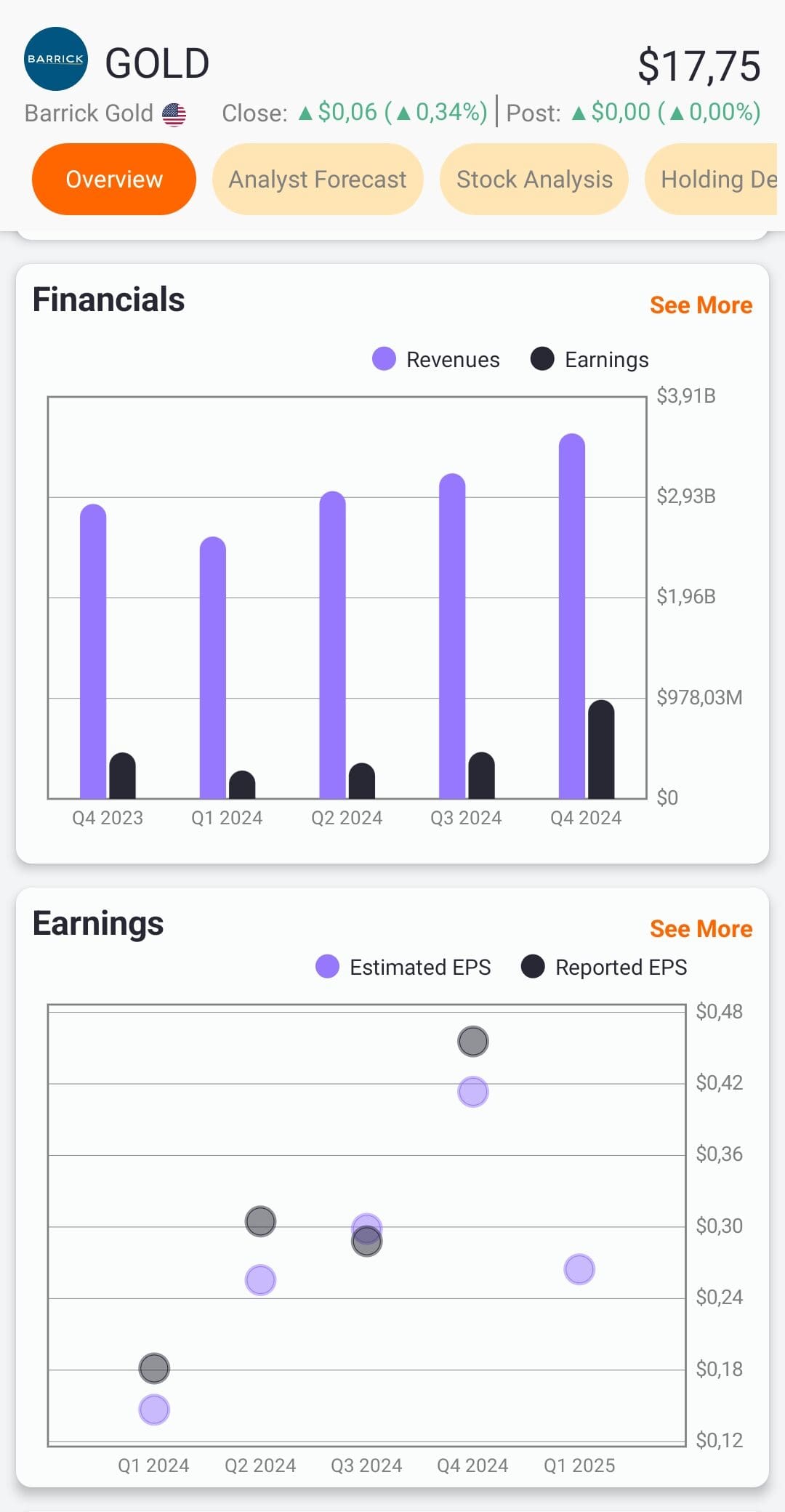

3. Company Fundamentals Have Deteriorated

Strong long-term stocks are built on solid fundamentals. If those start to unravel—like declining earnings, management shakeups, or mounting debt—it may be time to reassess.

Red flags that could warrant selling:

Falling revenue or consistent earnings misses

Leadership turnover or corporate scandals

Downgrades by analysts or credit agencies

A shift in business model that no longer inspires confidence

4. The Stock Is Overvalued and You've Made Strong Gains

It’s tempting to let winners ride forever, but sometimes locking in profits is the smarter play—especially if valuations become stretched or the stock has grown disproportionately large in your portfolio.

Reasons to consider taking profits:

Stock price has far outpaced earnings

Your position size has ballooned beyond your comfort zone

Valuation metrics like P/E ratios seem unsustainable

-

Selling to Realize Gains: Example

Suppose you bought Nvidia (NVDA) before the AI boom and it’s up 150% in 12 months.

Analysts are warning of frothy valuations, and your position is now 20% of your portfolio. Selling part of your stake allows you to lock in gains and reduce risk.

5. You Can Harvest Tax Losses on Losing Stocks

Tax-loss harvesting is a smart end-of-year tactic. Selling underperforming stocks at a loss can offset capital gains and reduce your tax bill.

Just make sure you don’t repurchase the same stock within 30 days, which would trigger the wash sale rule.

Tips for effective tax-loss harvesting:

Offset realized capital gains with losses

Replace with a similar (but not identical) stock if needed

Be mindful of the IRS wash sale rules

-

Using Stock Losses to Offset Gains: Example

Let’s say you bought Snap Inc. (SNAP) at a high valuation, and it's now down 50%. Selling to realize the loss could offset gains from other winners.

You might replace it with another social media stock, like Meta Platforms (META), to maintain industry exposure while staying compliant with tax rules.

6. When Better Investment Opportunities Emerge

Markets evolve, and the stock you once considered a top pick may no longer be the best option. Whether it’s a competitor outperforming or a newer company offering more upside, you might decide to switch.

Consider selling if:

Another stock offers better fundamentals, growth prospects, or valuation

Your original stock has stalled or matured

You want to reallocate to a sector or theme better aligned with future trends

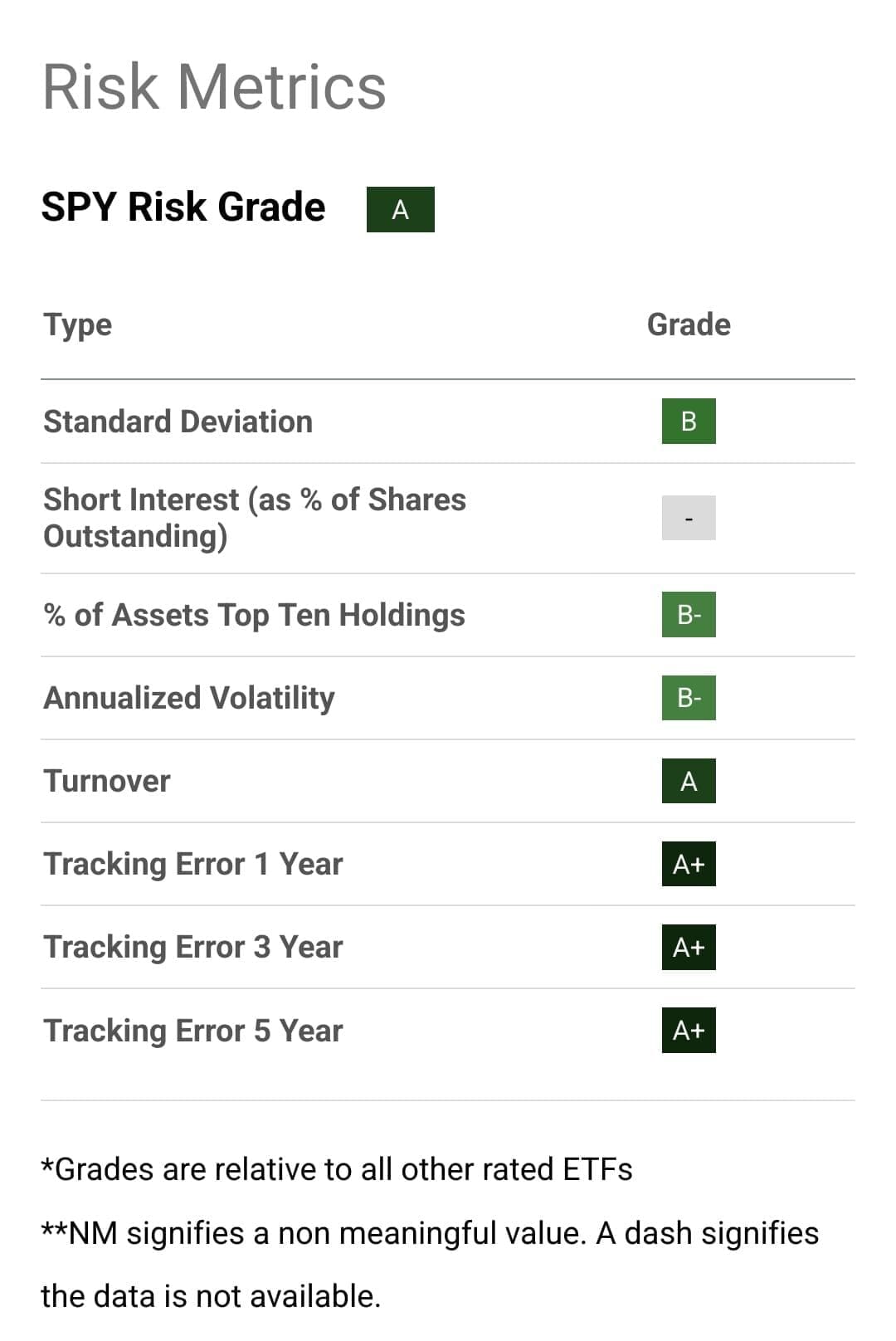

7. You’re Approaching Retirement and Want to Lower Risk

As retirement nears, preserving wealth often becomes more important than chasing returns.

Risky, volatile stocks might have served you well in growth years, but now could pose a threat to your income needs.

Steps to take:

Gradually reduce positions in high-volatility or speculative stocks

Shift into stable dividend payers or lower-beta companies

Align holdings with your anticipated withdrawal schedule

You can use tools such as Morningstar to analyze ETF and portfolio risk:

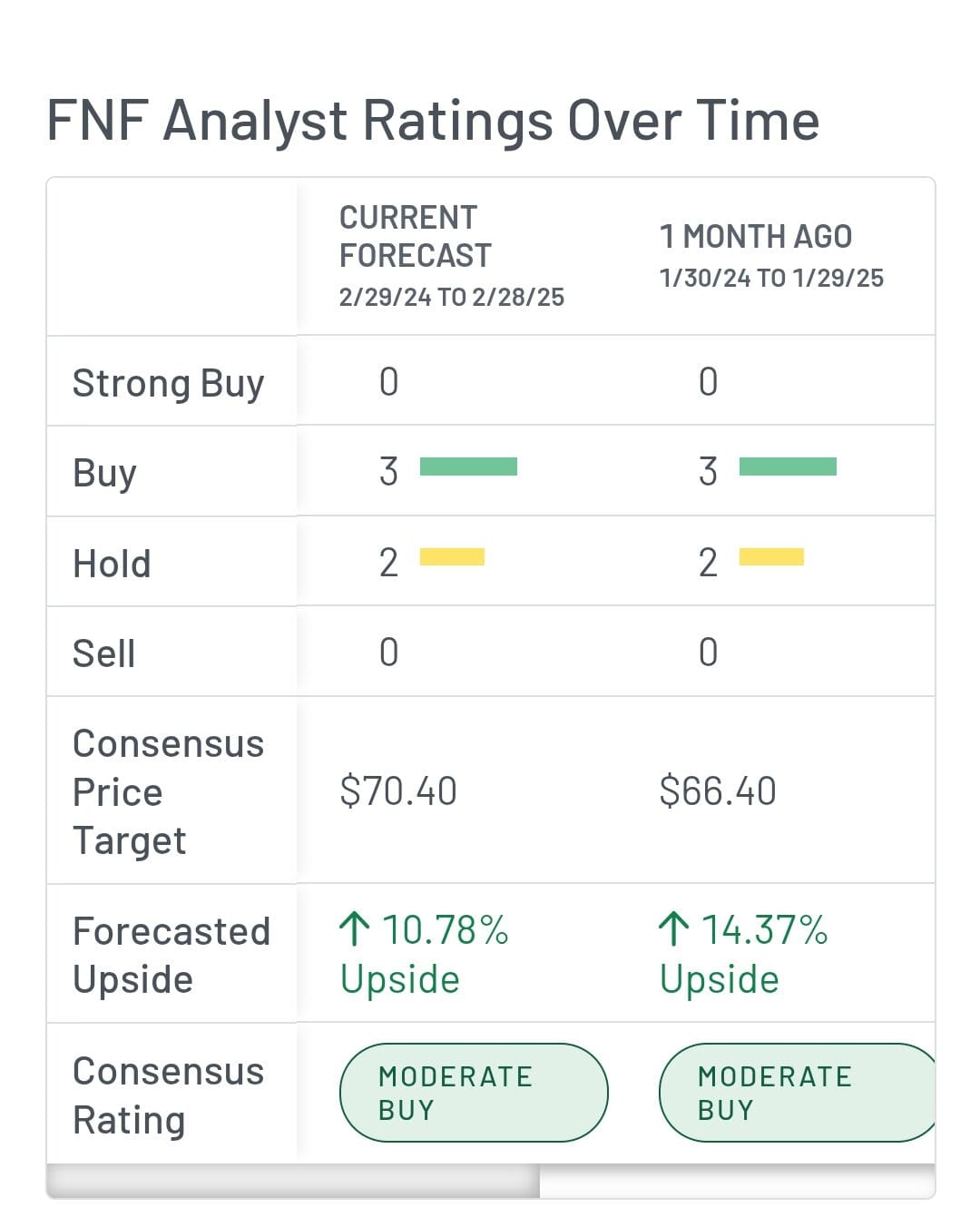

8. Insider Selling or Negative Analyst Sentiment

Large insider sales—especially by executives—can be a red flag if they happen frequently or in large volumes.

While not always a sign of trouble, paired with negative analyst downgrades or guidance cuts, it may indicate a loss of confidence in the company’s future.

Watch for:

Multiple insiders selling large amounts of stock

Analyst downgrades or reduced price targets

Lowered earnings guidance from the company

9. Regulatory or Legal Troubles

When a company faces major lawsuits, investigations, or new regulations, the uncertainty can impact its valuation, brand, and long-term performance. These risks are especially relevant in sectors like tech, healthcare, and finance.

Reasons to consider selling:

Ongoing government investigations or fines

Major legal settlements that hit the balance sheet

Regulatory changes that hurt the business model

10. Dividend Cuts or Suspensions

Dividend-paying stocks attract investors looking for steady income. When a company cuts or suspends its dividend, it may signal financial stress or shifting priorities—and often results in a stock price drop.

Red flags to watch:

Sudden dividend reductions without warning

Payout ratio climbing to unsustainable levels

Management commentary about preserving cash

-

Using Stock Losses to Offset Gains: Example

You’re invested in AT&T (T) for its high dividend. The company announces a dividend cut as part of a restructuring plan.

Not only does income decline, but the move may also reflect deeper financial challenges. If you’re relying on dividends, this might be a sign to exit.

FAQ

Investors typically sell when their goals change, a stock underperforms, or better opportunities arise. Life events, company issues, or market shifts can also be triggers.

Not always. A temporary dip may be part of normal volatility, but consistent declines tied to poor fundamentals or negative outlooks may justify selling.

If the stock’s risk level, sector, or performance no longer aligns with your investment goals, it may be time to reevaluate. Overlap with other holdings can also be a signal.

Taking profits is a smart move if the stock has grown beyond its fair value or dominates your portfolio. Selling helps reduce risk and rebalance your allocation.

Selling at a loss can help offset gains and reduce your tax bill, a strategy known as tax-loss harvesting. Just be mindful of the wash sale rule when reinvesting.

A dividend cut may indicate financial trouble or a shift in priorities. If income is your goal, or if confidence in the company fades, selling could make sense.

As you move closer to major milestones like retirement, your need for stability may increase. Selling high-risk stocks helps preserve capital and align with new goals.

News alone isn’t always a reason to sell, but if it reflects a deeper issue—like regulatory trouble or weak earnings—it’s worth reassessing your position.

Yes, especially if multiple analysts lower their ratings or price targets. This may indicate growing concern about the company’s future performance.