If you’re into stocks, crypto, or just tracking your portfolio vibes, Yahoo Finance has tiers for every level—from casual watchers to serious traders.

The free plan is great for real-time quotes and news, but the premium tiers offer expert insights, technical tools, and personalized trade ideas.

Whether you're just learning or already optimizing your portfolio, there’s a version that fits. So if you’re tired of switching between apps for research, charts, and news—you’ll want to level up here.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

What You'll Get On The Different Plans?

Here are main features included in all Yahoo Finance plans—Free, Bronze, Silver, and Gold—each providing different levels of depth depending on the subscription.

These tools are essential for investors and vary in usefulness based on investor goals and trading frequency.

-

Basic Screening Tools

All Yahoo Finance users can access stock and ETF screeners, which help investors filter assets based on metrics like market cap, price, sector, or region.

Free and Bronze users can find growth stocks, dividend payers, or ETFs by category.

Premium plans offer additional filters, such as fair value estimates and analyst ratings, which are useful for identifying undervalued opportunities or institutional favorites.

-

Real-Time Stock Quotes & Market News

Yahoo Finance provides real-time quotes and financial news in all plans, enabling investors to monitor live price changes and respond to breaking headlines.

Premium users get additional news from sources like Financial Times and The Information, providing institutional-level insights.

-

Company Profiles & Fundamental Data

All plans include access to income statements, balance sheets, and cash flow reports, helping investors evaluate financial health.

For instance, an investor researching Apple can check revenue trends, profit margins, and debt levels.

-

Portfolio Tracking & Watchlists

Users in all plans can link brokerage accounts, track multiple portfolios, and create unlimited watchlists, making it one of the best tools for portfolio tracking.

Premium plans, starting from Bronze, introduce performance breakdowns, volatility analysis, and sector diversification tools—ideal for investors managing larger or more diversified portfolios.

-

Technical Charting Tools, Alerts & Notifications

Yahoo Finance offers interactive charts with basic tools like RSI and moving averages for all users. A swing trader, for example, can view 6-month charts with volume overlays to identify entry points.

All plans support unlimited price alerts, allowing users to get notified when an asset hits a target price. For instance, a user tracking Nvidia can set alerts to buy if the stock dips below $800.

-

Additional Tools You Get on All Yahoo Finance Plans

All Yahoo Finance plans—Free, Bronze, Silver, and Gold—include several useful features that support everyday market tracking and investment research.

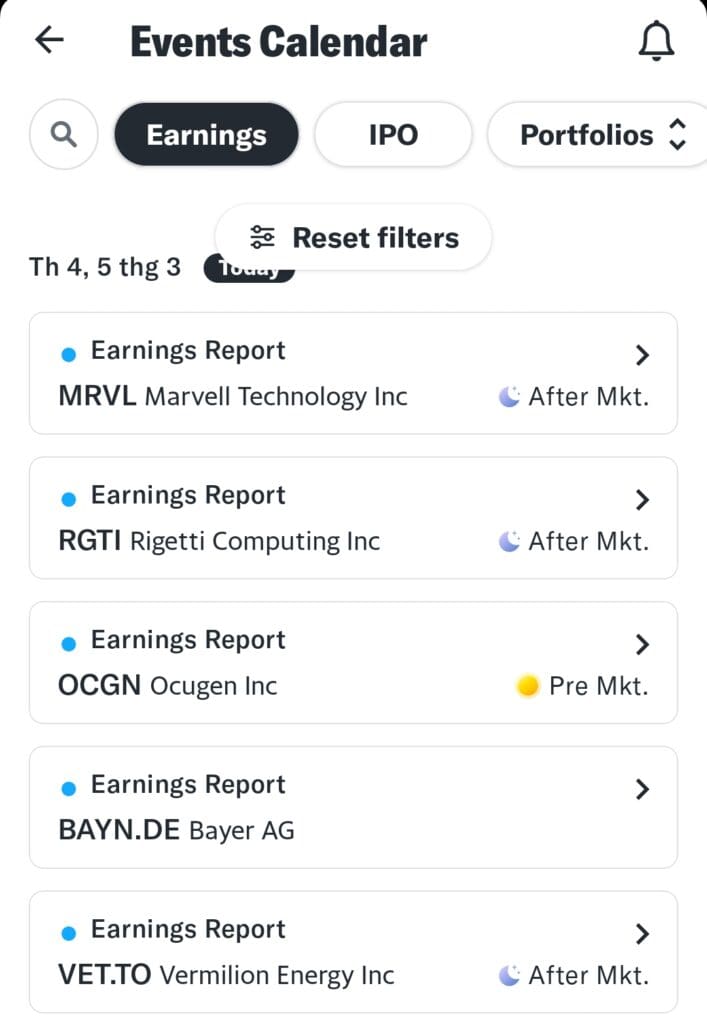

Earnings Calendar Access: Stay updated on upcoming quarterly earnings releases and key economic events like rate decisions or inflation reports.

Trending Stocks & Movers: Instantly see top gainers, losers, and most active stocks to spot market momentum and trading opportunities.

Cryptocurrency Market Tracker: Track real-time prices, market caps, and trends for Bitcoin, Ethereum, and other major cryptocurrencies.

Customizable Watchlists: Add stocks, ETFs, and crypto to unlimited watchlists and organize them based on your portfolio or market interests.

These features make Yahoo Finance useful for both beginners and experienced investors, providing essential tools to stay connected to the market.

What You'll Get If You Upgrade To The Bronze Plan?

Here are four unique features available in the Yahoo Finance Bronze plan that enhance the investor experience beyond what the free plan offers:

-

Portfolio Performance Tracking

Bronze users can analyze total returns, compare performance to benchmarks like the S&P 500, and review gains/losses across timeframes.

Unlike the free plan, which only shows price changes, this tool offers full portfolio-level insights—ideal for long-term investors reviewing strategy effectiveness or planning rebalancing.

-

Volatility & Risk Exposure Analysis

This feature lets investors assess how risky each holding is by analyzing beta, standard deviation, and historical volatility. It’s especially useful for those wanting to manage risk in volatile markets.

Free users lack this visibility, while Bronze users can identify and reduce overexposure to high-risk assets.

-

Visualize Sector Diversification

Bronze introduces portfolio visualizations that show how your investments are distributed by industry, market cap, or asset class.

This helps identify imbalances, like an overweight tech portfolio, and encourages better diversification.

It’s an upgrade from the free plan’s simple watchlist, offering a more strategic portfolio view.

-

Community Sentiment Insights

Bronze includes access to investor sentiment data that shows how other users feel about specific stocks. This helps traders gauge hype or caution in the market.

While free users can join conversations, Bronze adds a layer of sentiment analysis to support timing decisions and risk assessment.

What You'll Get If You Upgrade To The Silver Plan?

Here are four standout features that make the Yahoo Finance Silver plan a major upgrade over the Free and Bronze plans:

-

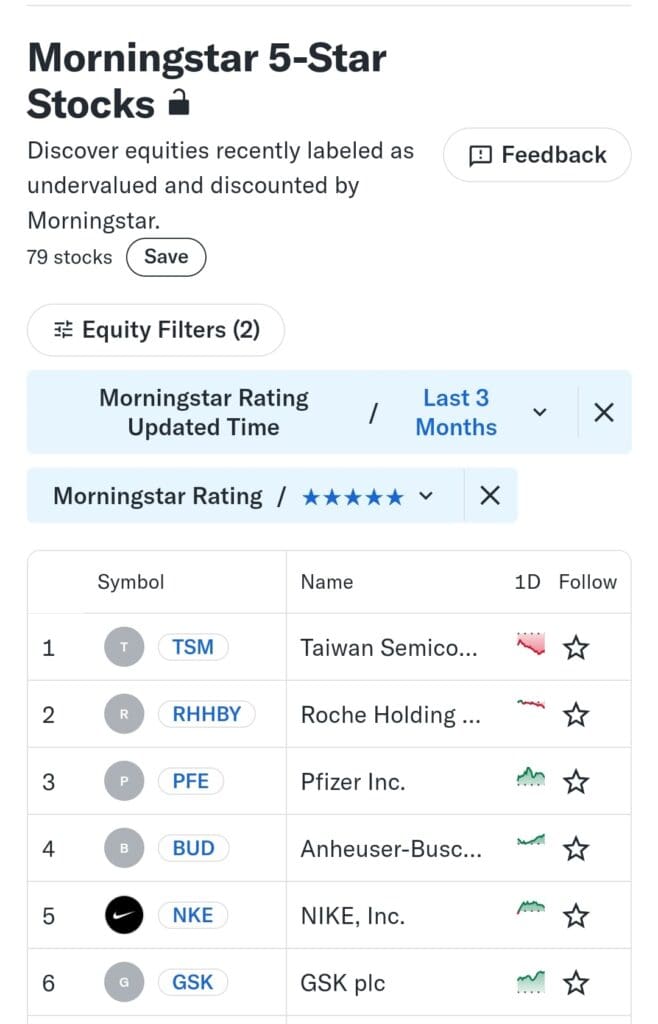

Morningstar Stock Ratings

Silver users gain access to Morningstar’s trusted 1–5 star ratings, which assess a stock’s fair value and long-term potential. These ratings help investors quickly identify undervalued or overvalued stocks.

The free plan lacks any expert stock grading, making this feature a valuable tool for more intelligent decision-making.

-

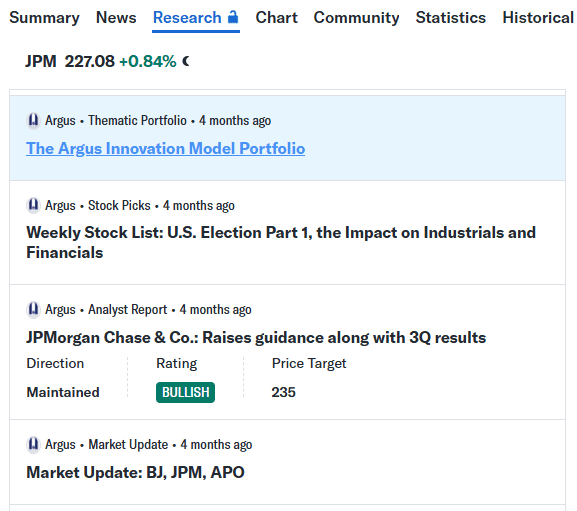

Argus Research Stock Picks

This feature provides detailed buy, hold, and sell recommendations from Argus analysts based on earnings potential, sector outlooks, and macroeconomic factors.

It’s ideal for long-term investors seeking credible second opinions. Free users must rely on public data alone, while Silver users get deeper insights from a research firm

-

Premium News Access

Silver unlocks full access to Financial Times and The Information—offering global market news and exclusive tech analysis.

These premium newsfeeds help investors stay ahead of trends, IPOs, and economic changes. Free users only get standard financial headlines, missing the depth that Silver delivers.

-

Model Portfolio Strategies

Silver subscribers can follow curated model portfolios tailored to different goals and risk levels. These strategies simplify diversification and help investors build balanced portfolios.

This guidance doesn’t exist in free or Bronze plans, making it especially useful for newer investors seeking expert-backed portfolio frameworks.

What You'll Get If You Upgrade To The Gold Plan?

Here are five exclusive features available in the Yahoo Finance Gold plan that take research, analysis, and portfolio management to the highest level:

-

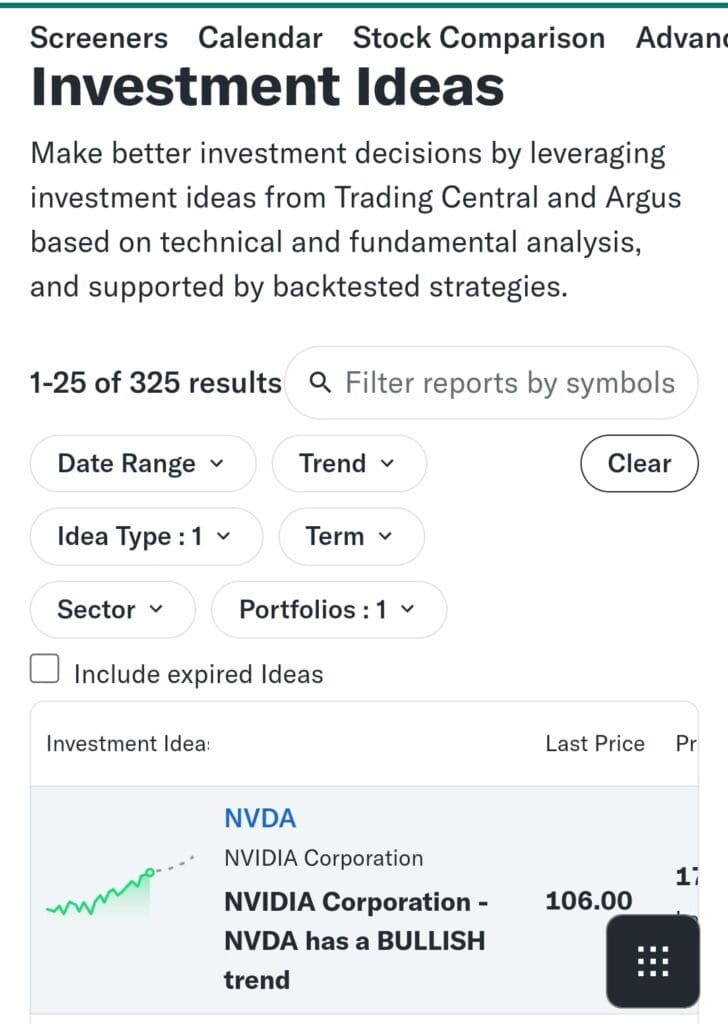

Personalized Trade Ideas

Gold users receive curated trade ideas based on their holdings, market trends, and technical signals. This tool helps investors uncover high-probability opportunities without extensive research.

Unlike lower tiers, this feature delivers actionable insights tailored to your interests—ideal for active investors seeking strategy guidance.

-

40 Years of Financial Data

This feature provides access to four decades of historical income statements, balance sheets, and cash flows. It allows for deep trend analysis and long-term valuation research.

Free and lower-tier users are limited to basic recent data, while Gold supports thorough historical backtesting and multi-cycle financial reviews.

-

Advanced Technical Chart Patterns

Gold unlocks 50+ technical patterns like double tops, head and shoulders, and trend reversals, plus annotation tools and alerts.

This is a major upgrade over the free and Bronze plans, which only offer basic charting. It’s essential for traders who rely on technical signals for entries and exits.

-

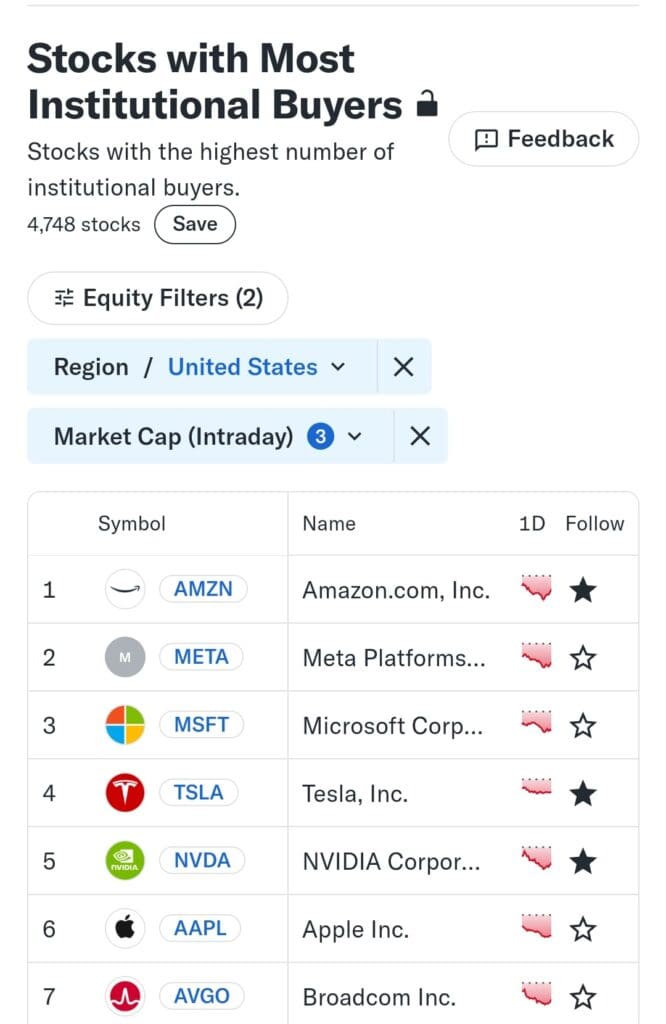

Smart Money Screener

This tool highlights stocks being bought by hedge funds and institutional investors. Users can filter for large accumulation trends, recent fund purchases, and analyst alignment.

Lower-tier plans lack this visibility, making Gold valuable for aligning with institutional sentiment and tracking big-money moves.

-

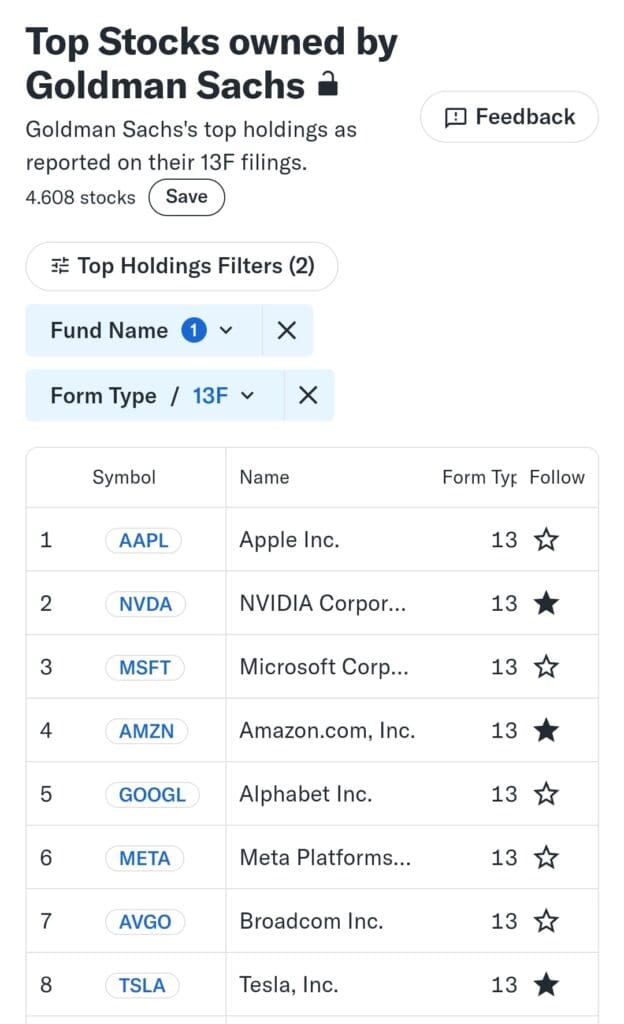

Top Holdings Screener

The Gold plan includes a screener that shows the most commonly held stocks by major funds and institutions. This feature helps investors spot high-conviction picks from respected money managers.

It’s a powerful upgrade from basic screeners, offering insights into what the pros are backing in real time.

Who May Want To Upgrade To Yahoo Finance Gold?

If you're seeking deep insights, technical tools, and smart money tracking, Yahoo Finance Gold offers the most advanced feature set.

Data-Driven Long-Term Investors: Access to 40 years of financials helps analyze company performance across multiple market cycles.

Active Technical Traders: One of the best tools for advanced chart patterns and technical alerts supports short-term trading strategies and pattern recognition.

Institutional Trend Followers: Smart Money and Top Holdings screeners reveal where hedge funds and institutions are investing.

Serious Portfolio Analysts: Export tools and personalized trade ideas make Gold ideal for custom backtesting and active rebalancing.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

Who May Want To Upgrade To Yahoo Finance Silver?

While having fewer options than the Gold plan, Silver is designed for investors who want trusted analyst research and expert-level tools without diving into complex technical trading.

Fundamental Stock Analysts: Morningstar and Argus ratings offer credible buy/sell signals backed by institutional-grade analysis.

Dividend-Focused Investors: Tools for evaluating payout safety and dividend growth help build a reliable income portfolio.

News-Driven Investors: Full access to Financial Times and The Information keeps users ahead of global financial trends.

ETF & Fund Builders: Model portfolios and screener enhancements help create diversified strategies aligned with risk tolerance.

Who May Want To Upgrade To Yahoo Finance Bronze?

Bronze is great for investors who want deeper portfolio insights, risk tracking, and a better user experience than the free tier.

Buy-and-Hold Investors: Track portfolio returns and sector exposure over time to support long-term goals.

Risk-Conscious Traders: Use volatility and beta analysis to manage exposure during uncertain market conditions.

Diversification-Focused Investors: Visualize holdings by industry and asset class to reduce concentration risks.

Engaged Market Watchers: Community sentiment data and ad-free browsing improve the daily research and tracking experience.

Which Investor Types Prefer Yahoo Finance Free Plan?

The free version is ideal for beginners or casual investors who need basic market tracking without paying for advanced tools.

New Stock Market Learners: Follow prices, earnings, and trends without overwhelming features or research jargon.

Passive Market Observers: Monitor market indices, trending stocks, and news with minimal engagement.

Basic Portfolio Trackers: Create watchlists, link accounts, and receive unlimited price alerts—all for free.

Swing & Momentum Traders: Use simple charts and real-time quotes to spot short-term opportunities with no subscription required.

Yahoo Finance Subscription: Is It Worth It?

If you’re into stocks, crypto, or just tracking your portfolio vibes, Yahoo Finance has tiers for every level—from casual watchers to serious traders.

The free plan is great for real-time quotes and news, but the premium tiers step it up with expert insights, technical tools, and personalized trade ideas.

Whether you're just learning or already optimizing your portfolio, there’s a version that fits.

So if you’re tired of switching between apps for research, charts, and news—you’ll want to level up here.